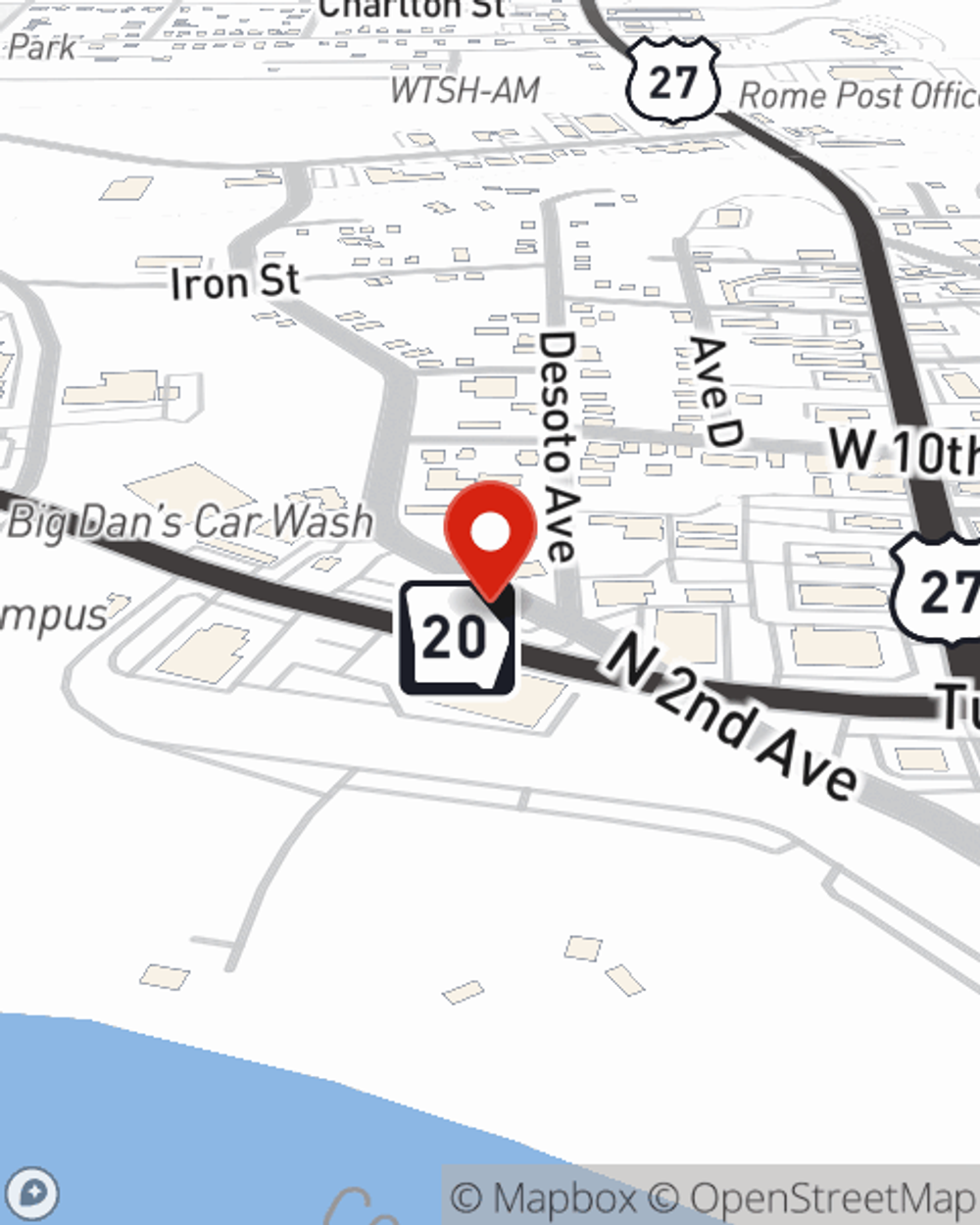

Business Insurance in and around Rome

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

- Rome

- N.W. Georgia

- Georgia

- Alabama

- Centre Alabama

- Cedar Bluff Alabama

- Leesburg Alabama

- Cedartown Georgia

- Lindale Georgia

- Euharlee Georgia

- Floyd County

- Bartow County

- Gordon County

- Chatooga County

- Polk County

- Fulton County

- Henry County

- Dekalb County

- Whitfield County

- Catoosa County

- Carroll County

- Haralson County

Insure The Business You've Built.

You've put a lot of resources into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a photography business, a hearing aid store, a veterinarian, or other.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, artisan and service contractors or business owners policies.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Brandon Burke is here to help you discuss your options. Reach out today!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Brandon Burke

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.